Mastering the Basics of Budgeting with ZeroBuckets

Budgeting doesn’t have to be complex. With the right structure and a few core concepts, you can take control of your finances and make intentional decisions every month. ZeroBuckets helps you do exactly that—with clear visuals, smart tools, and a system built around simple budgeting math.

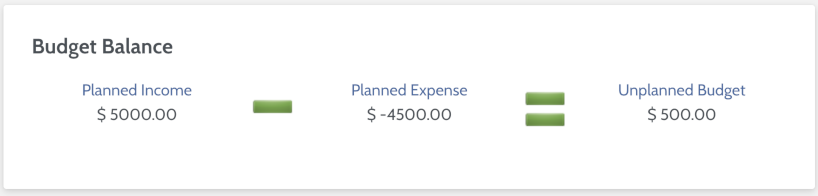

Budget Balance: The Equation That Drives Your Month

At the top of your dashboard, you’ll find a visual summary of your budget balance: Income – Expense = Remaining

- Planned Income: This represents all your income buckets for the month. These are positive values—money you expect to receive.

- Planned Expense: This includes all your expense buckets. These are negative values—money you plan to spend.

- Unplanned Budget (Remaining): This is the difference between your income and expenses. It should be zero or positive. A positive remaining balance means you have unplanned dollars left to allocate as the month unfolds. That’s a good thing—it gives you room to react to unplanned or emerging needs.

If your remaining balance is negative, that’s a red flag. You’re planning to spend more than you earn. To fix this, you’ll need to either:

- Add more income, or

- Transfer funds from savings.

Buckets: Organizing Your Budget

Every dollar in your budget should live in a bucket. These buckets are either:

- Income Buckets: Represent expected sources of money.

- Expense Buckets: Represent planned uses of money.

Each bucket has a name, a type (Income or Expense), and an amount. Income is shown as a positive number, while expenses are entered as negatives. This format allows the system to clearly show the remaining balance after all budgeted activity.

Linking Transactions to Buckets

Once transactions begin flowing into your account, you can link them to buckets to track your real activity against your plan.

Here’s how:

- Go to the transaction list.

-

Select a transaction (or multiple transactions).

- On Mac, hold Command to select multiple.

- On Windows, hold Control.

- Use Shift to select a range.

- Click the Link button.

- Choose the appropriate bucket.

- Click Link again to confirm.

This linking process keeps your plan aligned with reality—and helps you identify where your money is truly going.